Shares of Nokia (NOK) are surging while shares of Ericsson (ERIC) remain neutral or negative. Investors are finally realizing the undervaluation and major upside potential that Nokia has to its competitors.

New Nokia phones may be under way

Not long ago, the company officially announced that Nokia smartphones will adopt a new naming method. The names will have the form of a combination of two-digit letters to more clearly convey product positioning and meaning. Officially, Nokia will have three major smartphone series of X, G, and C.

Nokia X series will sport the latest technology, providing excellent experience. Plus, the phones from this line will come with the latest Qualcomm processors, Zeiss optical lenses, rugged design and many other features.

The G series will “popularize high-end technology”. Thus, phones from this series will have balanced configuration, long-life large batteries and high-pixel camera sensors.

The last C series is going to offer low-end models. They will run on the pure Android and cost quite affordable.

Nokia to lead Europe’s 6G research initiative

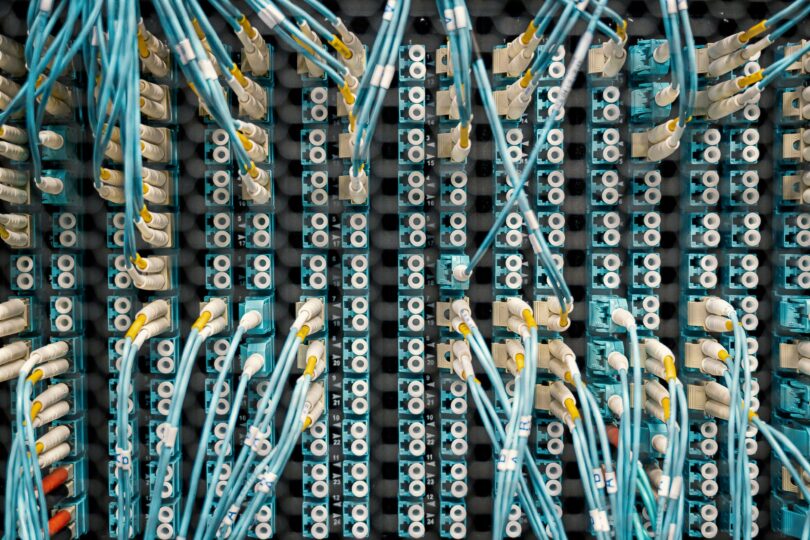

Nokia will lead the European Commission’s 6G research initiative, project Hexa-X, to help lay the foundation for the next generation of wireless and drive the 6G roadmap.

The two-and-a half-year Hexa-X initiative received funding from the EU’s Horizon 2020 research and innovation program and starts January 1, 2023.

Japan partners with Nokia, China may follow, leaving Ericsson behind

In addition, according to Nikkei, Japan has teamed up with Finland on 6G development. NTT and Nokia enlisted to help set standards in race with China.

Japan’s Beyond 5G Promotion Consortium will sign the agreement soon with Finnish group 6G Flagship. The accord is to be announced Tuesday at the Global Digital Summit 2023, an event organized by Nikkei and Japan’s Ministry of Internal Affairs and Communications.

The initiative follows a $4.5 billion commitment by Japan and the U.S. toward the development of next-generation communications technology, in a partnership announced in April. Extending the cooperation to “third-countries” to promote secure connectivity is seen helping in the competition with China to set global standards.

The Beyond 5G Promotion Consortium, which aims to commercialize 6G technology in the 2030s, includes the University of Tokyo along with major Japanese telecom players such as Nippon Telegraph & Telephone, NTT Docomo, KDDI, SoftBank Corp. and Rakuten Mobile. 6G Flagship is led by Finland’s University of Oulu.

Members of the Japanese consortium will engage in joint research projects and personnel exchange. The group is in talks for future collaboration with an American counterpart that includes telecom supplier Cisco Systems and chipmaker Intel.

Shares of 5G patents owned by Japanese developers have fallen behind the likes of South Korea’s Samsung Electronics and U.S. player Qualcomm. NTT Docomo holds about 6% of 5G patents, compared with roughly 10% for Qualcomm and China’s Huawei Technologies.

The internal affairs ministry aims for Japan to command at least a 10% share in 6G patents together with a slice of 30% or more in equipment and software.

Many investors expect China to follow and partner with Nokia for it’s own initiatives.