In the past weeks PHI Group (PHIL) has been the talk among over the counter (OTC) investors. The company is primarily engaged in mergers and acquisitions and advisory and consulting services with investments in certain industries. PHI Group main goal is to enhance long term shareholder value.

Is it time to short PHIL stock?

It may seem that PHIL is on the right track however, in my opinion, there are many other stocks that would be a better investment. One reason you should not invest in PHIL stock is because the CEO gives false promises on predictions that may or will never come true. According to their filings it seems they are way behind on reporting earnings and often seems scattered with which ending period they are reporting.

According to the SEC, the committee will require all brokerages to restrict buying and selling in OTC stocks tagged PINK NO INFORMATION.

On September 28, 2023, the new requirements take effect that will impact the market and value of certain over-the-counter (OTC) securities. The new rules apply to “Pink No Information” OTC securities of companies that fail to publicly report and keep current financial and other company information and will restrict the ability of U.S. brokers from making these products generally available.

The Securities and Exchange Commission (SEC) recently adopted amendments to SEC Rule 15c2-11 governing the submission and publication of OTC quotations. These amendments will prohibit broker-dealers from submitting or publicly disseminating bid/ask quotations for OTC securities of issuers that do not meet enhanced information filing requirements.

Securities of issuers that make the required information publicly available by the deadline in the rule should not be affected. In a tweet by the company, the CEO said that he would be current by then, however he has promised numerous times and failed to deliver.

Short Price Target $0.0025

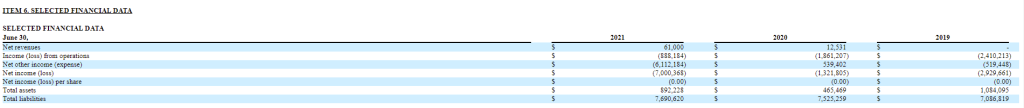

According to PHIL’s 10-K:

The company’s net revenue $61,000 while their Marketcap stands at $135MM. There is no proof that the company generates more than $61,000 but is able to spend $100MM to purchase 70% of Five-Grains.

Revenue from the acquired companies simply do not windfall upon the acquirer that quickly.