** The NFGC stock ticker will not be accessible until NYSE listing starts next week. Current OTC ticker is $NFGFF **

Anyone who follows gold mining or mining exploration in general has probably heard about the modern-day gold rush that is occurring on the island of Newfoundland in Canada. The company and juggernaut that started this gold rush, New Found Gold, just got word on Thursday that its application to uplist to the NYSE was certified. With its DTC eligibility already in place, it is only a matter of a couple days until New Found Gold (NFG) will be more readily available to US investors through tools like RobinHood and self-directed retirement accounts.

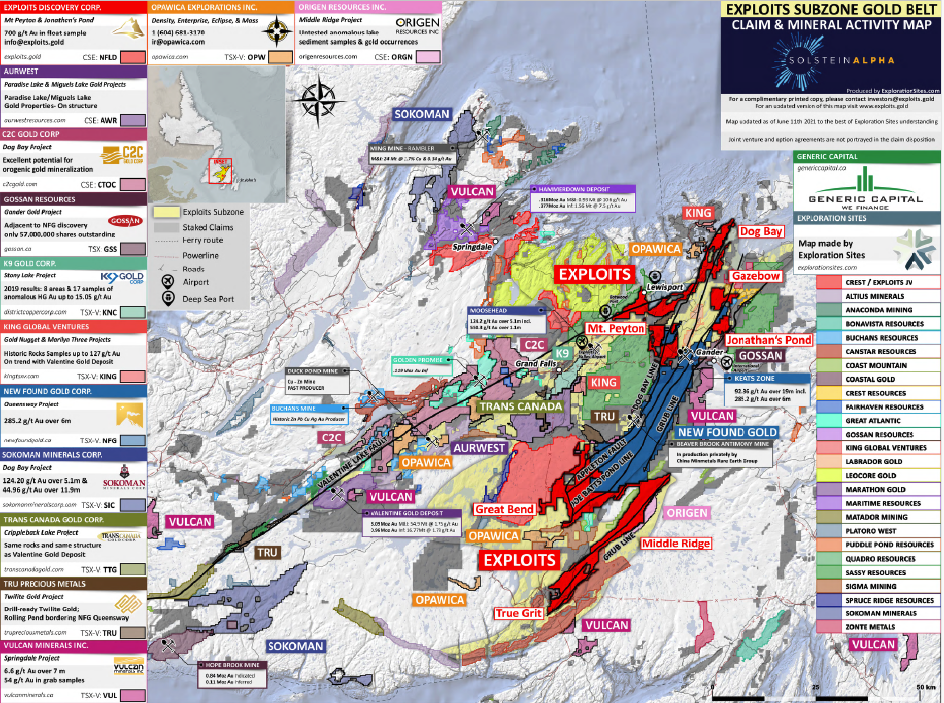

The easiest way to tell that NFG is several notches above the rest of the pack, just go look at web pages of the 20-30 companies that are currently doing exploration work in Newfoundland. With rare exception, every single company discussed the location of its claims in relation to NFG’s Queensway Project. Queensway has become the lingua franca of the Newfoundland gold rush and it appears ready to make its next major jump now that it will be available to a much larger contingent of US retail investors.

Why Is Queensway Such a Big Deal?

When analyzing mining exploration companies, whether companies are able to realize monster gains or fizzle comes down to a few key criteria – land, capital, management, and infrastructure. If all four of these come together it has the potential to produce truly extraordinary long-term returns. In the case of Queensway, all four of these criteria fit together seamlessly.

Land

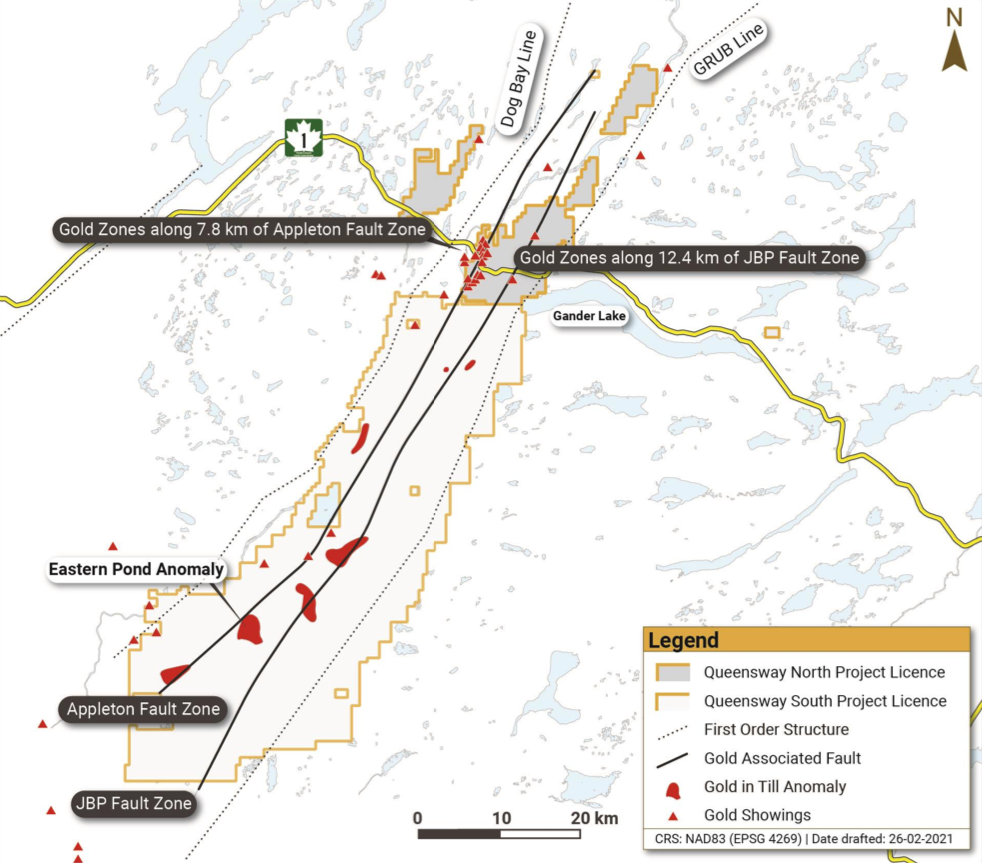

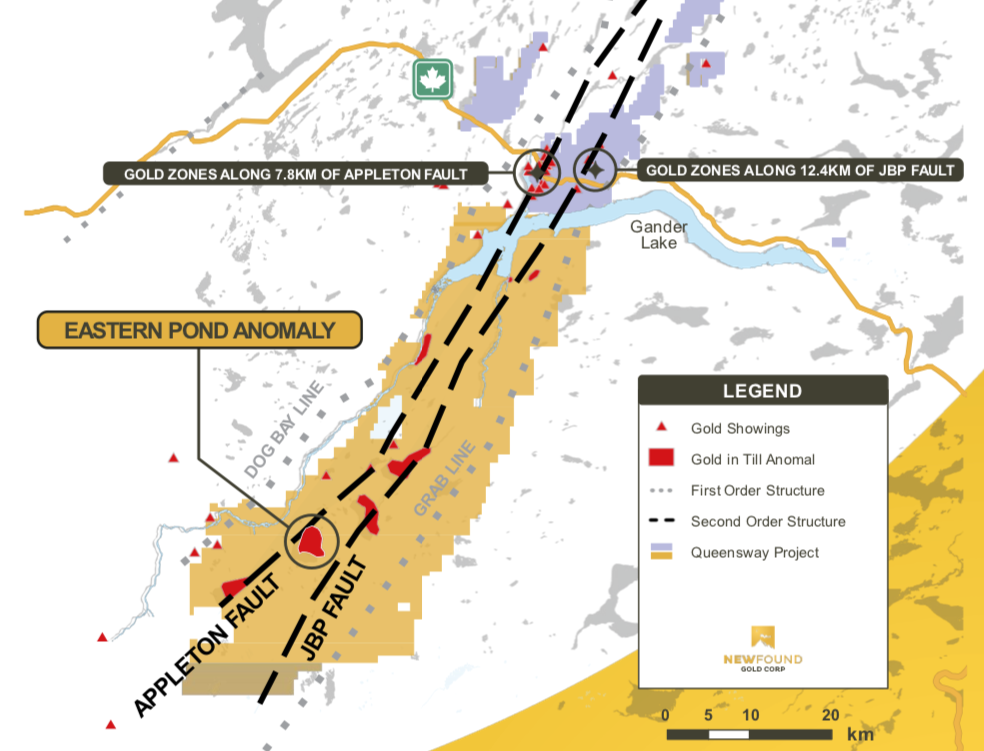

Why is attention all of a sudden being focused on Newfoundland. Back in 2015, geologist Denis Laviolette staked out and optioned a set of claims running about 70km between two distinct primary structures running from NE to SW through the middle of the island called the Dog Line and the Grub Line.

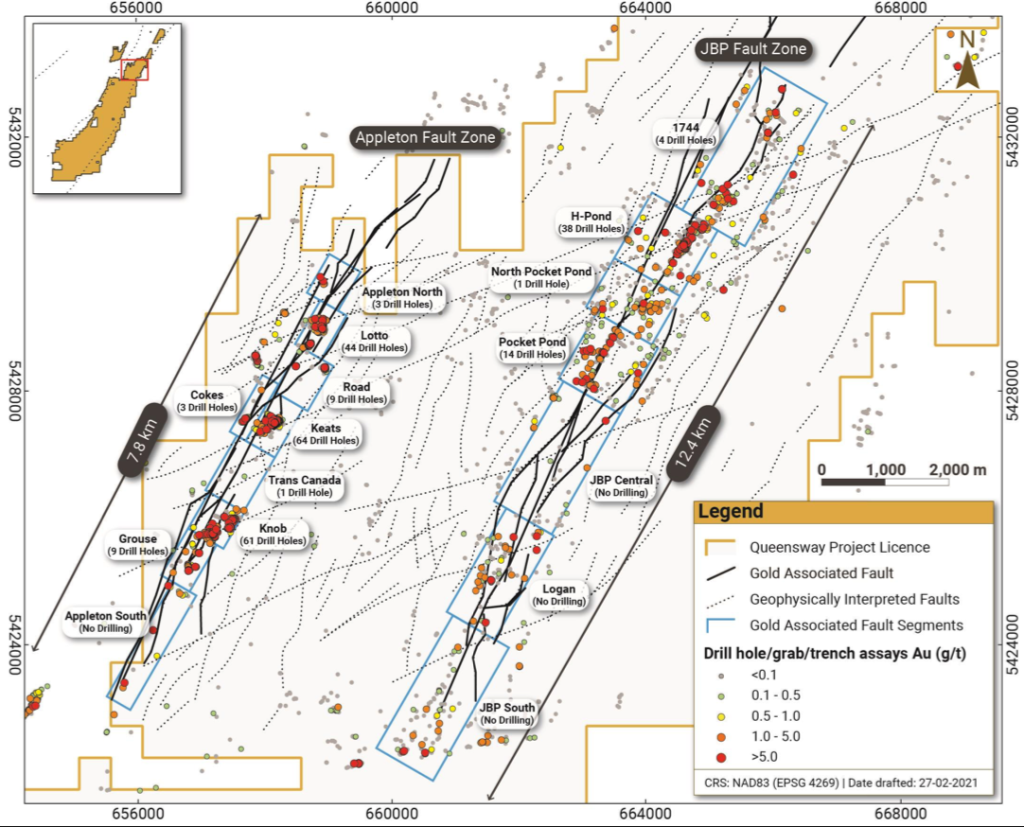

Between these primary structures are two well-defined fault lines (Appleton Fault and JBP Fault). Over the last several years, NFG has started a cutting-edge geological analysis of the claims that total more than 1,500 sq. km. As it so happens that Laviolette is also the co-founder and Exec Chair/President of Goldspot Discoveries, the AI geological company that has been making its own waves at the same time.

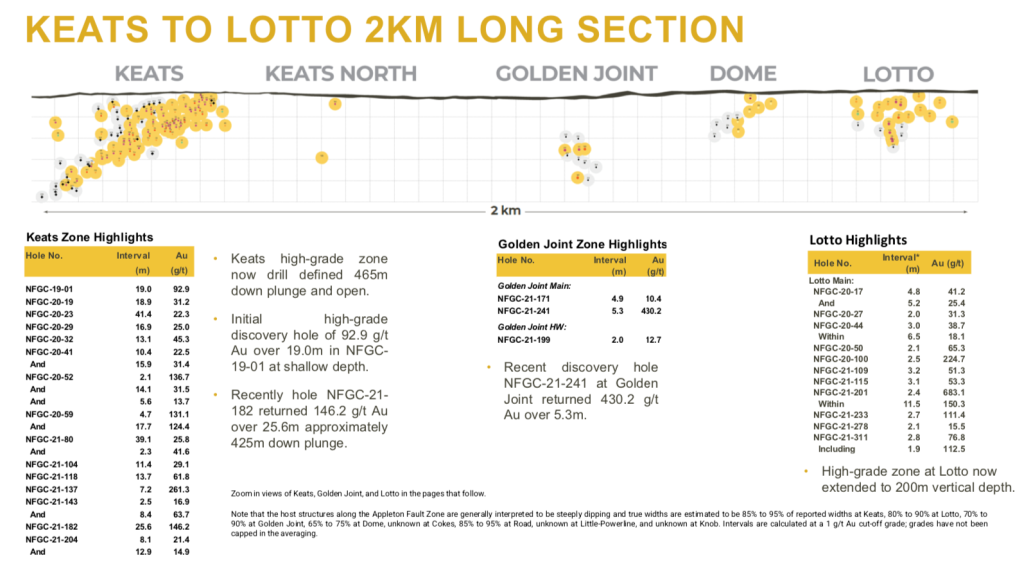

Newfoundland caught the attention of the entire mining exploration industry when NFG released results of its first drill core results in late 2019 (92 g/t over 19m) located in what is called the Keats Zone. For reference, a general rule of thumb in the gold exploration world is that anything over 100 gram-meters is considered a good drill hole so seeing almost 1,750 gram-meters in its first hole took the industry by surprise. Not only was there high grade gold in the sample, but it was epizonal deposits within quartz almost identical to what was found at the Fosterville Mine in Australia. That property was bought by Kirkland Lake in 2015 for $1B, and since that time, Kirkland Lake ($KL) has seen its stock price go 5x and estimated profits to Kirkland Lake from Fosterville are in the neighborhood of $15-20B since its acquisition.

Since that time, NFG has embarked on a very ambitious 100,000 meter drilling program that was quickly upgraded to 200,000 meters. The Keats Zone appears to be a well-defined gold channel at least 300 meters in length. But the crazy part is that all along the southeast boundary of the Appleton Fault, there appears to be a well-defined system running at least from Keats to another zone (Lotto) that is 2 km to the North. Three intermediate drill locations on the primary structure of the fault have also produced high-grade results suggesting that there is high likelihood of a continuity of the gold-bearing structure throughout the entire length of the 2km.

But it gets better! High grade gold has also been found in samples multiple kms further north and south along the fault edge. As the evidence keeps building, it appears that the high-grade gold channel may extend the entire length of the 70 km of the Appleton fault that lies within NFG’s claims. And that is only one of the two fault structures. High grade gold soil samples have also been found in the structures around the JBP fault which also runs for 70km through NFG’s claims. Who knows how many Fosterville’s will be found in Queensway.

This is a high-grade gold system that has few comparables. In what is shaping up to be a multi-mine district-scale gold strike is almost entirely sitting within the control of one company – NFG.

As can be seen, this story is only getting started as NFG has done large scale exploration on a small portion of its claims – but the amounts of shallow high-grade gold residing within quartz channels within the Keats-Lotto Zone make the economics of NFG line up very favorably.

It would be hard to name another exploration company sitting on undeveloped claims that rival NFG. So when it comes to having a top-quality land package – NFG is second to none.

Capital

Access to capital is a perpetual problem in mining exploration. In order to develop large land packages, companies need access to large amounts of capital that will be spent prior to the time that the mining company begins earning any revenues. Fortunately, NFG has had no problem raising capital. The company is currently sitting on more than $100 million in cash and has been able to raise large amounts of cash on very aggressive and favorable terms. NFG will only require about half of its cash to complete its 200,000m drilling program that should conclude by the end of the next year. As the company continues to make additional high-grade finds, it is reasonable to expect that raising adequate capital shouldn’t be an issue going forward based upon the amount of gold already known to be in the ground.

Management

NFG is led by a strong and experienced management team, starting with co-founders Denis Laviolette and Collin Kettell. In addition to its management, NFG has been strongly supported by Eric Sprott (you know, the guy who blew up the uranium market recently), who controls 20% of the shares in NFG and has vigorously maintained his stake participating in subsequent equity raises. NFG has also been active in supporting adjacent and nearby claim holders, including investing in neighboring Exploits Gold and Labrador Gold. NFG is also a founding member of industry trade alliance Newfoundland Gold. Laviolette has also retained strong ties with several of the other mining exploration companies in the region through Goldspot Discoveries. All of this suggests that NFG will be able to marshall the resources necessary to complete the exploration of Queensway and prepare the land package for a future merger or acquisition.

Infrastructure

One thing that is incredibly unique to Newfoundland is that it is a great mining jurisdiction with access to very strong infrastructure resources. The Trans-Canadian Highway bisects Queensway right to the south of the Keats Zone. Almost the entirety of the claims have access to existing roads and nearby access to adequate and cheap power. Newfoundland also has an established mining community that should provide an adequate labor source for continued exploration operations.

Conclusion

NFG is one of the most exciting gold prospects I have ever come across. Based on the fact that NFG has been able to grow up to a market cap of $1B within a year of going public suggests that I am not alone in that opinion. While seeing a $1B market cap may make many potential investors balk thinking that they missed the boat on NFG and that its best days are behind it… the truth is that NFG’s project at Queensway is just getting started. On top of that, Fosterville sold for $1B before KL even really knew what was on the property. This stock still has plenty of room to move upo.

The ticker on the NYSE will be $NFGC and should be available starting early next week. If you want to get a jump on the rush, shares can be acquired right now on the OTC at the ticker $NFGFF or on the TSX-Venture at $NFG.

It will be fun to watch a modern day gold rush play out and no other mining exploration company has the claims or resources to make a big splash than New Found Gold!

This article was written by u/SnidelyWhiplash1