TLDR – $AMGN is targeting $BCRX for acquisition, which could bring other suitors knocking. E.g. Takeda

- Amgen is falling behind peers in their rare disease / orphan drug pipeline

- They tried fixing it by acquiring Alexion, $BCRX’s rival but failed

- Now a former surgeon general and **Amgen’s head of R&D, reg affairs and Strategy has joined $BCRX’s board of directors.

- Thus, My Hypothesis Amgen is targeting $BCRX for acquisition

Request – Asking for your thoughts to support or disprove this hypothesis? Also, let me know if we should cross post on another board that might have more information to add.

—

Hi BCRX Reddit Apes, over the weekend, we stumbled across a bull thesis at Biocryst that could make many people rich and need your help to connect more dots. This could be the biggest biotech acquisition since 2018. I am a dyslexic ape, so please forgive the tyops and all those elements. FYI, the post is written in chronological order for better readability.

Hypothesis: Amgen is targeting Biocryst for acquisition

Why could Amgen be targeting Biocryst?

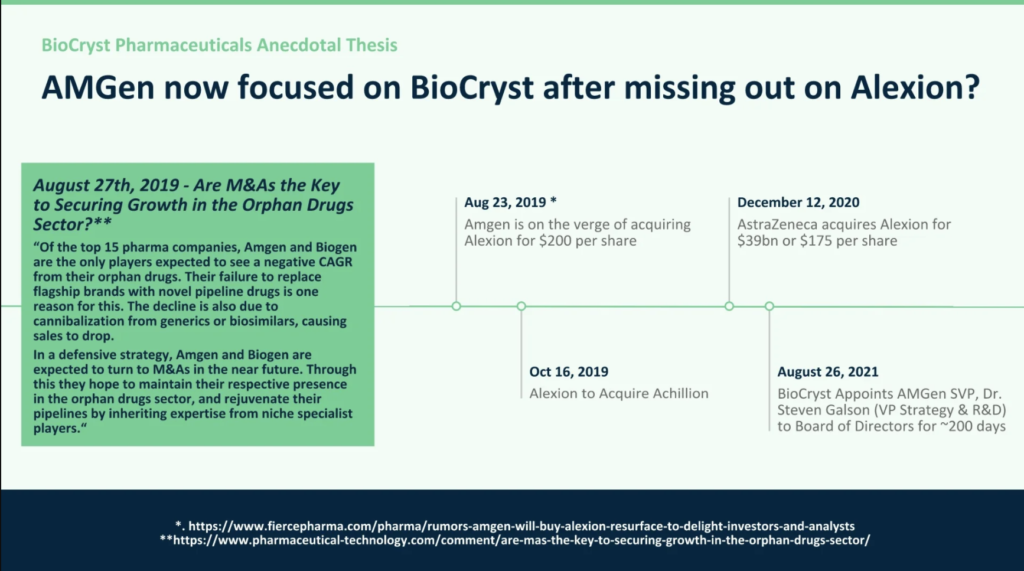

- Amgen Lacking Compared to Peers – Aug 19′ – Of the top biotech companies, Amgen identified as lacking orphan drugs or rare disease drugs in their pipeline compared to peers; the article noted that acquisitions were likely to fill the void.

- Filling the Void – Aug 19′ – Amgen was rumored to buy Alexion, Biocryst’s orphan drug / rare disease rival, for $200 per share – the largest biotech deal in years.

- Talks Broke Down, and Amgen’s gap not Filled – Fall 2019 – Amgen and Alexion talks broke down, and they went separate ways again. Amgen bought the drug Otezla for ~13 billion, and Alexion acquires Achillion for a ~billion.

- COVID -19 Pause – January/August 2020 – The World Came to a halt due to COVID-19

- Amgen Officially Lost the Chance to Fill Gap – Fall 2020 – AstraZeneca bought Alexion for a massive $39 billion, the largest deal in 2020! The agreement closed in April 2023. Amgen is officially back on the hunt for a rare disease company in April.

Thesis: Now that Amgen cannot acquire Alexion, they are focusing on Alexion’s rival Biocryst to fill the rare disease gap in their portfolio.

- $BCRX is Booming! – January – May 2023 – Biocryst Launches Orladeyo, their 1st major rare Disease drug, and it has been a big success. Last week, they were nominated for the best drug launch in 2023. Also, BCX9930 moved into Pivotal Studies FAST by FDA in PHN, and by the way, BCX9930 has shown to be grossly superior to AstraZeneca / Alexion’s PNH drugs. Oh, By the way, Biocryst has two antiviral drugs that have shown a lot of promise in not curing Covid-19 but reducing viral loads to buy more time (think Gilead’s remdesivir).

Now, Enter the Crazy-Unexplained-Hormonal-Behavior from Biocryst over the last month or so

- We Are going to be Rich; just hold baby!!!!! – Biocryst announces that its cash runway is fantastic thanks to Orladeyo, and the BCX9930 Pivotal Study’s are on track. CEO says no secondary offerings will be issued because there is no need for cash. ( I could add more here but want to keep it short)

- Wait, Huh, we are letting our CBO go and bringing in a CEO to be on our board – July 2023 – Biocryst parts way with CBO, who would lead mergers and acquisitions. Vincent Milano added to BOD. Vincent is an outstanding rare disease CEO at Idera and a significant competitor to Amgen. Also, Idera holds ~500 patents and intellectual property’s in oncology and other rare diseases that Amgen would love to have

- What? Do I even know you anymore? – Biocryst issues a secondary warrant offering, but you said you wouldn’t ???? Can I even trust you anymore?

- Celebration is back on, memes and gifs for everyone – The next day, the secondary warrant offering was canceled. Biocryst, I knew I could trust you, and I was joking about all the bad things I said about you yesterday! BTW, Was that a poison pill?

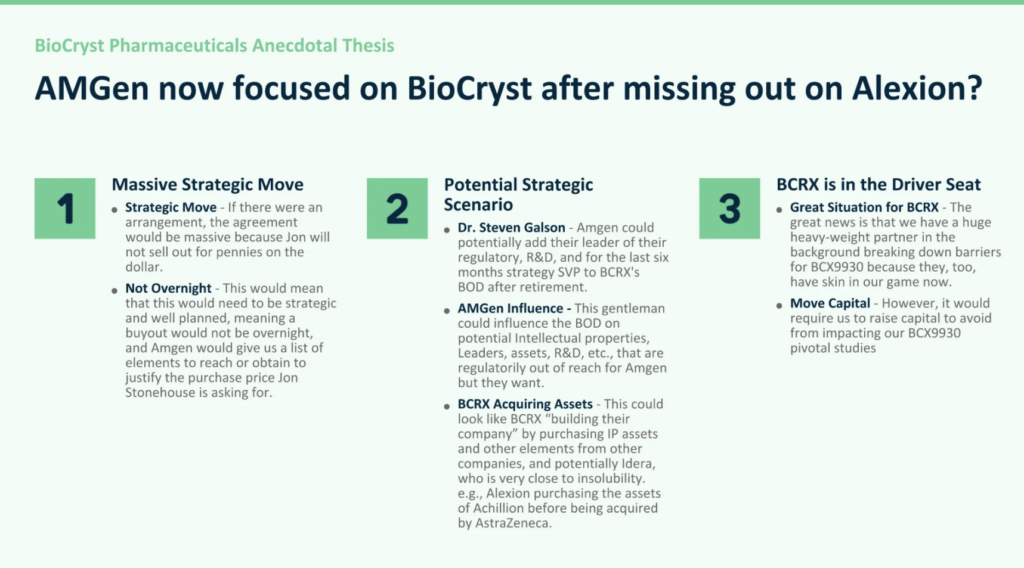

- Shut the Front Door; the former Surgeon General is on our BOD now??!! – Last week, Biocryst issues a PR that states Biocryst has now appointed a new board of director Dr. Kenneth Galson, the former US Surgeon General & Director of the Center for Drug Evaluation and Research; you know the place that approves NDA’s and Final Marketing approvals. However, and most importantly, he is the head of strategy, R&D, and regulatory at Amgen.

Summary

So could Amgen be looking to target Biocryst and have put Dr. Galson on our board to protect their interest? Is Dr. Galson on our board of directors so he can help indirectly influence the board on the assets to acquire that would make Biocryst an even more attractive target for someone like maybe possibly a company with the first name that starts with an A and ends with an N? e.g., IP, patent, and other assets that regulators might block if Amgen went after them directly?

So, we are pleading for your help to substantiate our thoughts and anecdotal thesis. Are we reading too much into this? Is it strange that a CEO of another company joined our board? Is it common for an acquiring company to place a director on the BOD of a target company? Have you seen a similar situation happen in the past? I would love to hear your thoughts.

Other loose connections

- William (Bill) Sheridan, Biocryst’s chief Medical Officer, was the North American Medical Affairs VP at Amgen for over ~14 years.

- Can you think of others?

Disclaimer – I have many shares in $BCRX, $AAPL, $GOOG, Ethereum, and a few other bad positions that I am too embarrassed to share and should have never bought.

This article was written by u/Noisybeats