TSMC rival GlobalFoundries to IPO, reportedly talking to potential advisers about the possibility of an offering at a roughly $20B to $30B valuation. Company owner Mubadala Investment has been looking at Morgan Stanley, JP Morgan, and BofA Securities as an underwriter, however, details could still change.

GlobalFoundries came into existence when United Arab Emirates-based Mubadala purchased Advanced Micro Device’s manufacturing facilities in 2009 as AMD turned to outside fabrication. The facilities were later combined with Singapore-based Chartered Semiconductor Manufacturing.

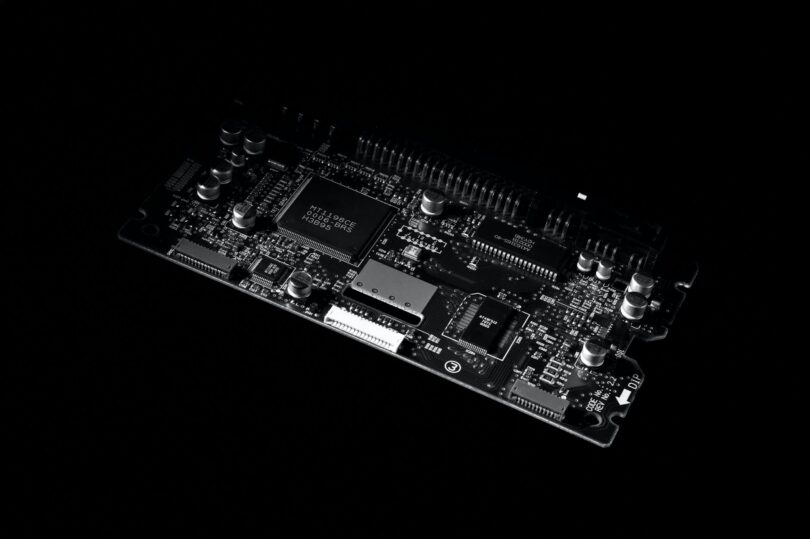

GlobalFoundries is a major semiconductor maker that competes with the likes of Taiwan Semiconductor Manufacturing Co. (TSMC) and South Korean-listed Samsung. The global chip shortage has turned all of the industry’s players into hot properties.

Chip giant Advanced Micro Devices (NASDAQ:AMD) recently disclosed in a filing that it had signed an agreement with GlobalFoundries locking in a minimum supply of wafers for computer chips through 2024’s end.