Artificial Intelligence Technology Solutions (AITX) files an impressive 10-K detailing the business and financial standpoint which gives a clear picture into present and future operations.

According to the 10-K, the company is cleaning up debt and liability which will improve credit and financing opportunities. AITX is currently looking to uplist to OTCQB expected later this year.

What is the business of AITX?

RAD’s solutions are offered as a recurring monthly subscription, typically with a minimum 12-month subscription contract. RAD’s solutions are expected to earn over 75% gross margin over the life of each deployed asset when under subscription. RAD also sells units which generally limits gross margin to the 50% range.

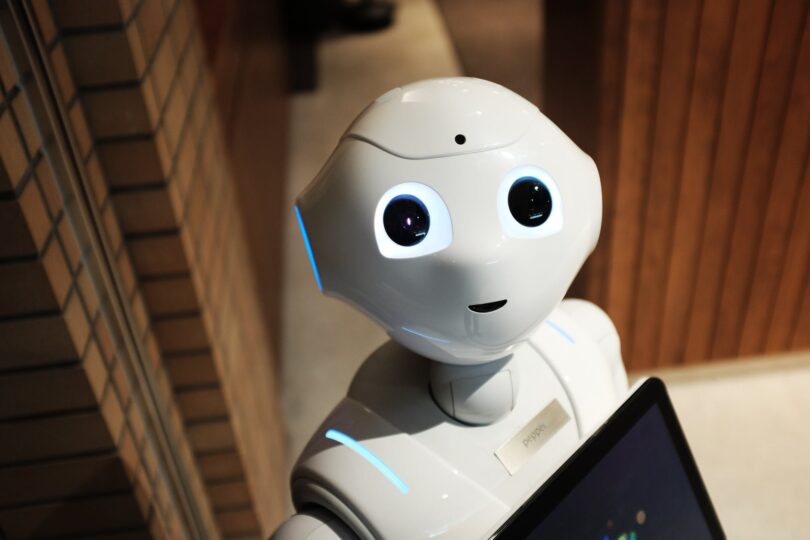

Specifically, RAD provides workflow automation solutions delivered through a system of hardware, software and cloud services. All elements of hardware and software design offered by RAD are 100% designed, developed and owned by RAD except for gunshot detection capabilities. EAGL Technologies supplies RAD with gunshot detection technical features through a dealer agreement.

Price targets and compensation

There are two objectives which AITX CEO will gain a bonus. For objective 1, the price per share has to stay above $0.30 for 10 days and for objective 2, the price per share has to stay above $0.50 for 10 days. For more information read the 10-K report.